Choosing Health Insurance #2 -- the "Side Effects"

Nov 24, 2014

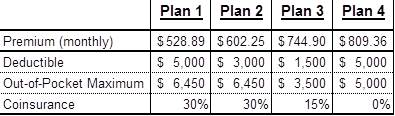

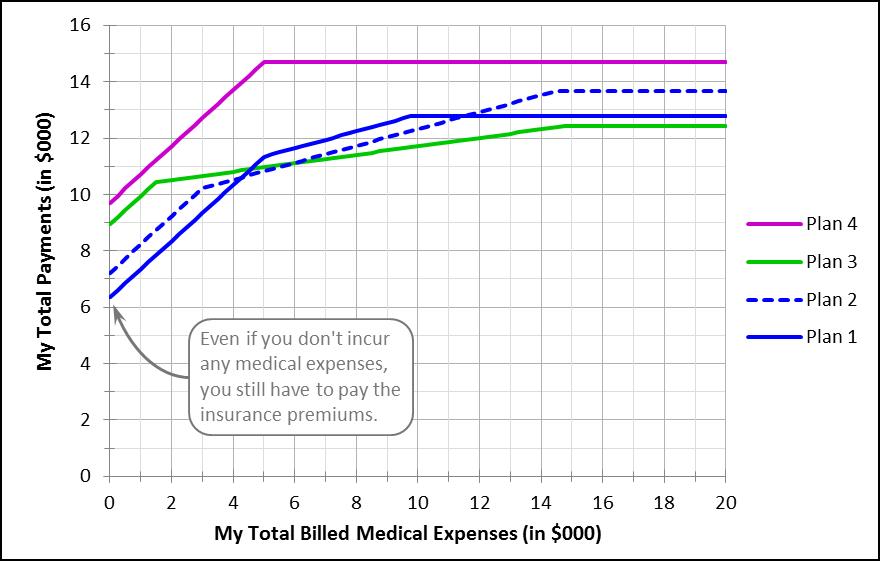

Let’s take a little more time to consider the question of choosing a health insurance policy. In my last post we looked at these choices:

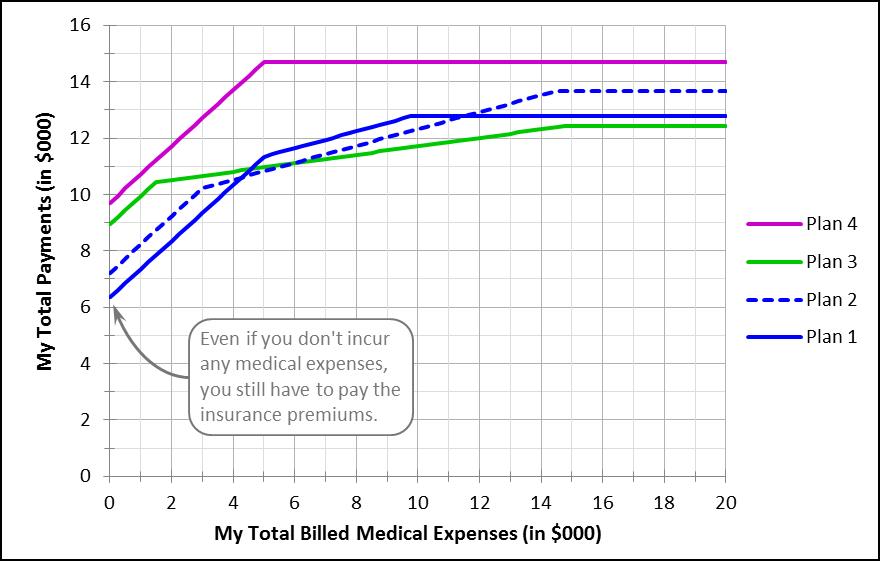

A graph of what the cost to you will be – depending on the total medical expenses you incur – looks like this:

This is a great start – with a graph like this, you can choose the insurance plan that minimizes your total medical expenses given your most likely medical situation. Or at least the one that works best under the circumstances you’re most concerned about – you may be basically healthy but on a tight budget, or financially comfortable but worry about a truly expensive unexpected situation.

But either way, there are complications. When choosing the right insurance plan, you should also factor in:

There are of course other factors you should be aware of, but the above are among the ones with the largest dollar impact. Choosing a health insurance plan is a stressful experience for most of us, so if you think these posts help, please feel free to share them with others.

In my next post, we return to data visualization, and the political party composition of the U.S. House of Representatives.

“Painting with Numbers” is my effort to get people to focus on making numbers understandable. I welcome your feedback and your favorite examples. Follow me on twitter at @RandallBolten.

A graph of what the cost to you will be – depending on the total medical expenses you incur – looks like this:

This is a great start – with a graph like this, you can choose the insurance plan that minimizes your total medical expenses given your most likely medical situation. Or at least the one that works best under the circumstances you’re most concerned about – you may be basically healthy but on a tight budget, or financially comfortable but worry about a truly expensive unexpected situation.

But either way, there are complications. When choosing the right insurance plan, you should also factor in:

- The doctors/facilities in your “network.” The financial terms mentioned above (deductible, O-O-P maximum, coinsurance) typically apply only to doctors and healthcare facilities that have agreed to be in that plan’s “network.” To make sure that the doctors and facilities you might want to use are in a plan’s network, check that plan’s provider directory.

- Out-of-network costs. For out-of-network care, plans do reimburse, but have higher deductibles and O-O-P maximums and lower coinsurance rates. Given your particular situation, how expensive is that likely to be for you?

- Copay vs. coinsurance. In copay plans, your payment is a fixed amount, such as $25 for a doctor’s appointment or $400 for an emergency room visit, rather than a percentage of the bill, such as the 30% coinsurance rate for Plan 1 shown in the table above. Copays are often a better deal than coinsurance rates, but regardless you may need to make some adjustments to your model.

- Differences in treatments covered.Not all plans cover the same set of procedures or medical needs, or cover them at the same coinsurance/copay rates. If you’re concerned about this, read the plan details to see exactly what is and isn’t covered.

- Do they pay their claims? Some insurance companies are less bureaucratic and less argumentative than others. If you or people you know have strong experiences with a specific provider – either bad or good – they might be worth factoring in.

There are of course other factors you should be aware of, but the above are among the ones with the largest dollar impact. Choosing a health insurance plan is a stressful experience for most of us, so if you think these posts help, please feel free to share them with others.

In my next post, we return to data visualization, and the political party composition of the U.S. House of Representatives.

“Painting with Numbers” is my effort to get people to focus on making numbers understandable. I welcome your feedback and your favorite examples. Follow me on twitter at @RandallBolten.

Related Blogs

Other Topics

Other Topics